India is emerging as a significant player in the global cryptocurrency ecosystem. With its tech-savvy population and increasing interest in digital finance, the country is witnessing rapid growth in crypto adoption. Cryptocurrencies are not only seen as investment opportunities but also as tools for innovation in areas like decentralized finance (DeFi), remittances, and blockchain-based solutions.

However, this growth comes with its own set of challenges, including regulatory ambiguity, financial risks, and concerns about misuse. This article delves into the opportunities and challenges associated with the rise of crypto adoption in India.

Opportunities of Crypto Adoption in India

1. Financial Inclusion

Cryptocurrency has the potential to bridge the gap for India’s unbanked and underbanked population. With just a smartphone and internet access, individuals in rural or underserved areas can participate in financial ecosystems, accessing services like savings, payments, and loans.

2. Remittance Market

India is one of the largest recipients of remittances globally. Cryptocurrencies offer a faster and cheaper alternative to traditional remittance channels, reducing transaction fees and delays.

3. Blockchain Innovation

Indian startups and developers are leveraging blockchain technology for various applications, including supply chain management, digital identity verification, and smart contracts. Crypto adoption complements this innovation by providing a financial layer to decentralized applications (dApps).

4. Employment Opportunities

The growing crypto ecosystem is creating job opportunities in sectors like blockchain development, crypto trading, and fintech. This aligns with India’s push toward becoming a global technology hub.

5. Investment Diversification

Cryptocurrency provides Indian investors with an alternative asset class, diversifying portfolios beyond traditional options like real estate, gold, and equities. Younger investors, in particular, are drawn to the high growth potential of crypto assets.

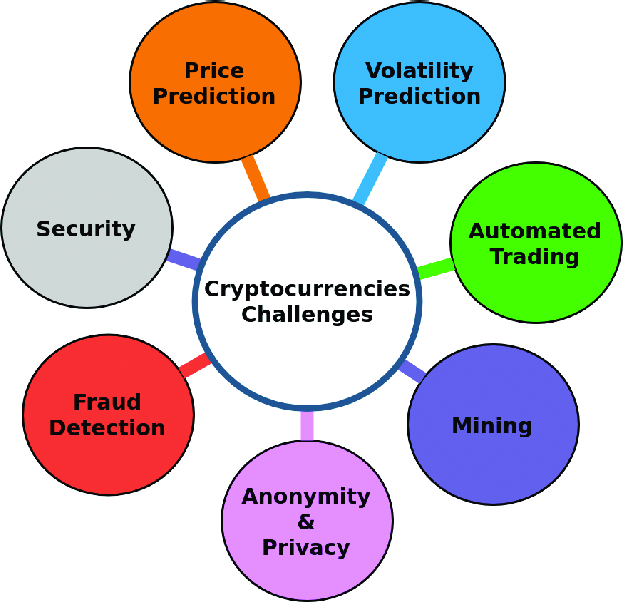

Challenges of Crypto Adoption in India

1. Regulatory Ambiguity

The lack of clear regulatory frameworks remains a major hurdle. While cryptocurrencies are not banned, they are not officially recognized as legal tender either. This creates uncertainty for businesses and investors.

2. Taxation and Compliance

Cryptocurrency transactions are subject to high taxation in India, with profits taxed at a flat rate of 30% and a 1% tax deducted at source (TDS) on trades exceeding certain thresholds. These measures discourage smaller investors and traders.

3. Security Concerns

Crypto scams, hacking incidents, and phishing attacks pose risks to new investors. The absence of regulatory oversight exacerbates these issues, leaving users vulnerable to financial losses.

4. Volatility

Cryptocurrencies are known for their price volatility, making them a risky investment. Sudden market fluctuations can deter risk-averse investors and lead to significant losses.

5. Environmental Impact

India’s adoption of energy-intensive cryptocurrencies like Bitcoin raises concerns about sustainability. The high energy consumption associated with mining adds to the debate about crypto’s environmental impact.

The Way Forward

Regulatory Clarity

The Indian government is working on introducing comprehensive regulations to govern cryptocurrency use, focusing on protecting consumers while fostering innovation. A clear framework will help legitimize the industry and attract institutional investment.

Public Awareness

Educational campaigns and resources are crucial to empowering users with the knowledge to navigate the crypto space safely. Enhanced awareness can mitigate risks like scams and poor investment decisions.

Green Crypto Solutions

Adopting energy-efficient consensus mechanisms like proof-of-stake (PoS) and investing in renewable energy for mining operations can address environmental concerns.

Industry Collaboration

Collaborations between crypto platforms, regulators, and financial institutions can help create a balanced ecosystem that promotes innovation while ensuring compliance and security.

For more related topics you can check our following topics:-

The Future of Crypto in 2024: Key Trends to Watch

Litecoin Mining- Learn How To Do It?

Ripple mining- How to Mine Ripple?

How Cryptocurrency Is Changing the Whole Banking System

Crypto Wallets 101: Choosing the Right Wallet for Your Needs

Sustainable Cryptocurrency: Can Crypto Go Green?

How to Spot Crypto Scams and Protect Your Investments

Is Cryptocurrency Legal in India? Here’s the Latest Update

Crypto Mining Explained: Is It Still Profitable?

How to Use Cryptocurrency in Everyday Transactions

Final Thoughts

The rise of crypto adoption in India represents a transformative opportunity for financial inclusion, innovation, and investment diversification. However, addressing challenges such as regulatory uncertainty and security concerns is essential for sustainable growth.

By fostering a supportive regulatory environment and promoting responsible adoption, India can position itself as a leader in the global cryptocurrency landscape, paving the way for a new era of digital finance.