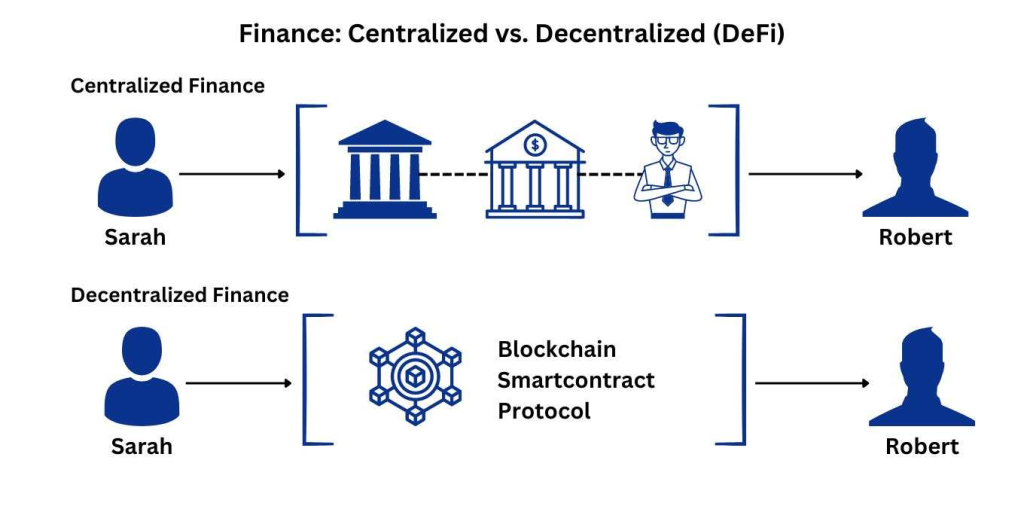

Decentralized Finance (DeFi) represents a revolutionary shift in the financial landscape, utilizing blockchain technology to create a transparent and accessible financial system. Unlike traditional finance, which relies on banks and centralized institutions, DeFi operates on decentralized networks, enabling peer-to-peer transactions without intermediaries.

By offering tools such as decentralized lending, borrowing, and trading, DeFi empowers users to take control of their assets. This article delves into how DeFi works, its benefits, challenges, and what it means for the future of money.

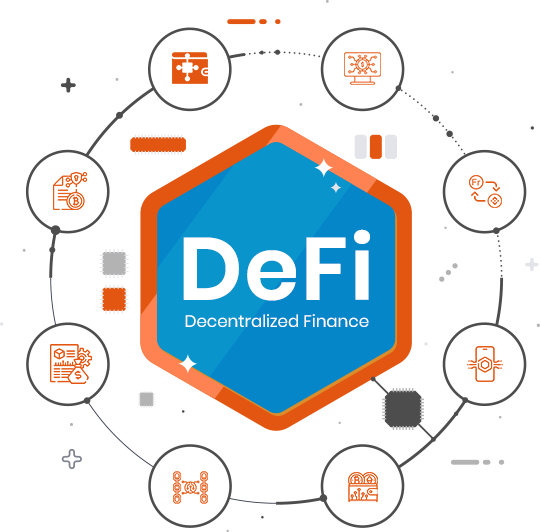

What is DeFi?

Decentralized Finance refers to financial applications built on blockchain networks, primarily Ethereum, that eliminate intermediaries like banks. These platforms use smart contracts—self-executing agreements with predefined rules—to facilitate transactions securely and transparently.

DeFi encompasses a range of services, including decentralized exchanges (DEXs), lending protocols, yield farming, and stablecoins, allowing users to perform financial operations directly with one another.

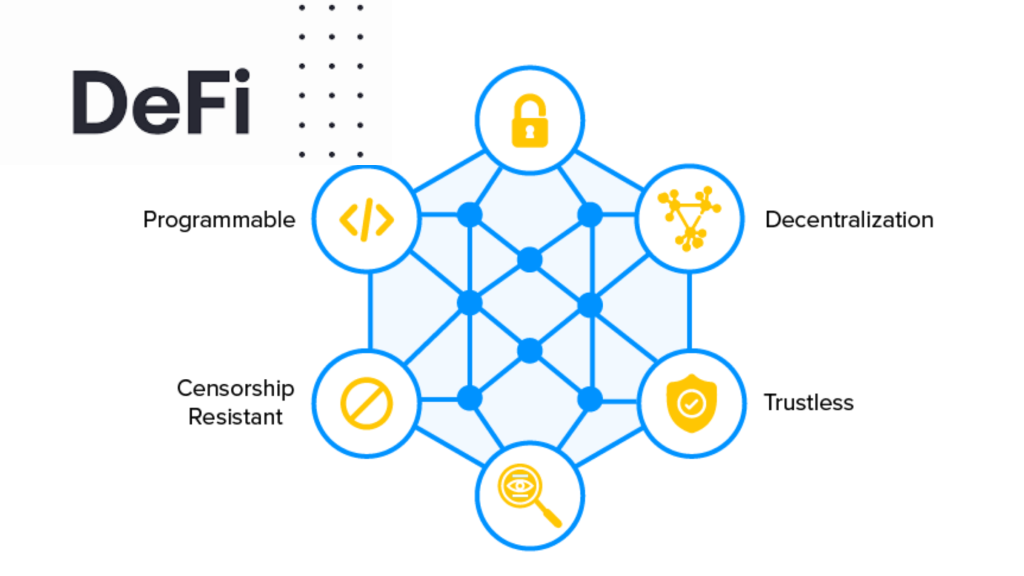

Core Features of DeFi

- Transparency: Blockchain ensures that all transactions are publicly recorded and verifiable, fostering trust and accountability.

- Accessibility: DeFi platforms are open to anyone with an internet connection, removing barriers for the unbanked or underbanked populations worldwide.

- Interoperability: DeFi applications often integrate seamlessly, enabling users to transfer assets or leverage services across platforms without restrictions.

Popular DeFi Applications

1. Lending and Borrowing

Platforms like Aave and Compound allow users to lend their assets and earn interest or borrow against collateral. This eliminates the need for traditional credit checks or lengthy application processes.

2. Decentralized Exchanges (DEXs)

DEXs like Uniswap and SushiSwap enable users to trade cryptocurrencies directly from their wallets, without a central authority managing the exchange.

3. Stablecoins

Stablecoins like DAI and USDC are pegged to fiat currencies, offering a stable store of value in the volatile crypto market. These coins are integral to DeFi ecosystems.

4. Yield Farming and Staking

Users can earn rewards by staking their assets or providing liquidity to DeFi platforms. These practices incentivize participation and ensure network stability.

Benefits of DeFi

- Financial Inclusion: DeFi democratizes finance, giving millions of unbanked individuals access to essential services like savings accounts and loans.

- Cost Efficiency: By removing intermediaries, DeFi significantly reduces transaction fees and delays, making services more affordable.

- Control and Ownership: Users retain full control of their assets, eliminating the risk of custodial failures or institutional collapses.

Challenges Facing DeFi

- Security Risks: The reliance on smart contracts introduces vulnerabilities. If a contract is poorly written or hacked, users’ funds can be at risk.

- Regulatory Uncertainty: The lack of clear regulatory frameworks poses challenges for DeFi adoption and compliance, particularly in regions with strict financial laws.

- Complexity: DeFi platforms can be difficult for beginners to navigate, creating barriers to widespread adoption.

The Future of DeFi

Mainstream Integration

DeFi is poised to integrate with traditional financial systems, offering hybrid solutions that combine decentralization with institutional trust.

Expansion Beyond Ethereum

As blockchain technology evolves, DeFi applications will expand to other networks, reducing congestion and transaction costs.

Enhanced Security

Developers are focusing on creating more secure smart contracts and protocols to mitigate risks and enhance user confidence.

Final Thoughts

Decentralized Finance is reshaping the global financial system by making it more accessible, transparent, and efficient. While challenges like security and regulation remain, the potential of DeFi to democratize money and empower individuals is undeniable.

As DeFi matures, its impact on the future of money will likely be profound, offering an inclusive, efficient, and equitable financial ecosystem for all.