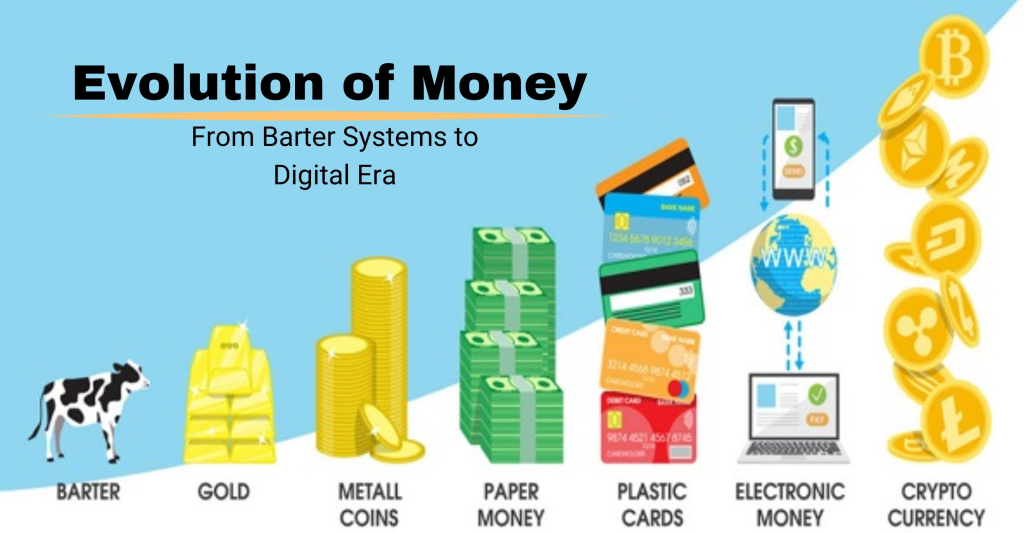

Do you hear about Ripple/XRP or about any crypto currency? If not then Ripple for beginners will guide the clients who have zero ideas about it till now. The Ripple is a crypto currency like Bitcoin which having P2P network for making global payments. According to the survey, it has been found that Ripple goes most advanced in terms of technology. In simple works we can say that to make faster and secure payments we can use ‘Ripple’ rather than a bank, PayPal etc. It does not charge you extra money to complete the whole process except the payment amount. Thus ‘Ripple’ creating a new infrastructure to give you a hassle free transaction system at all. It also improves the reliability as well as the efficiency in Ripple Net.

Basically, Ripple is a global company which is situated in countries like India, London, San Francisco, Sydney, New York, Singapore, and Luxembourg. The team contains various segments that control the overall network of Ripple Net. The main CEO of this company is Brad Garlinghouse and also having other officials too. The World Trade Organisation has calculated that the whole infrastructure of this company costs around $1.6 trillion. Even the Ripple claims to provide the seamless and friction free services to all their clients. Without taking more time let us know more from the topic Ripple for Beginners.

How is Ripple for Beginners benefitted?

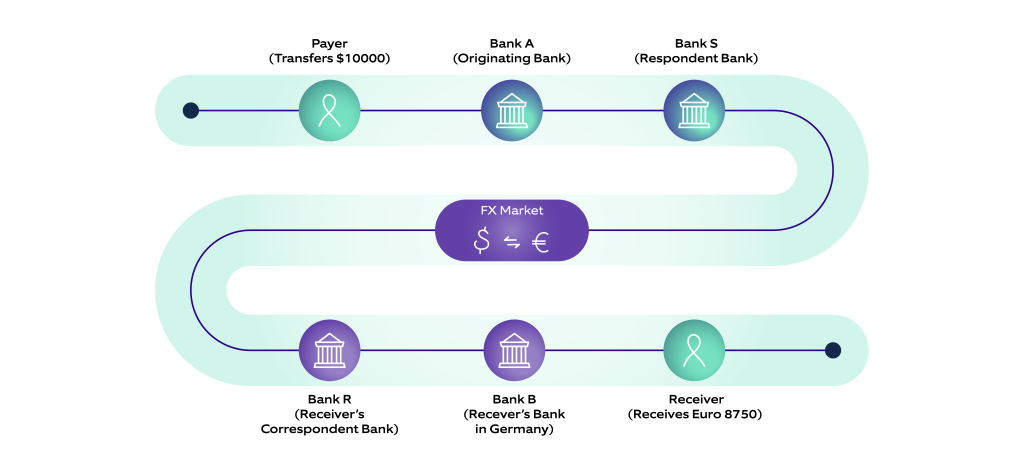

Now we are moving to the point that guides you how Ripple is benefitted for us in real life. Basically, it improves the infrastructure of the payment by replacing the delay and extra fees. Thus the most cost-effective as well as the reliable payment network is provided by Ripple Net. Without taking the headache, you send and receive money globally.

Rather than using the global payment system of bank or PayPal, simply go through the Ripple Net for instant services. You also trace your funds in real time for your satisfaction and the service is only provided by them.

Is Ripple better than another Blockchain?

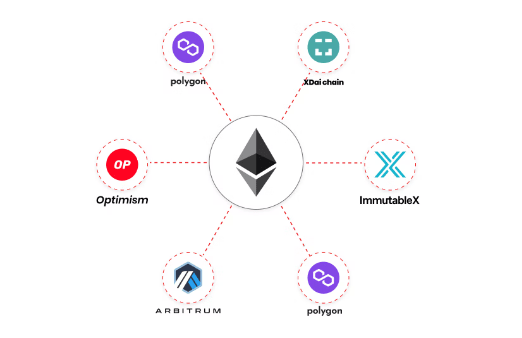

Yes, Ripple is much better than another Blockchain because it used the most advanced technology in it. Moreover ripple also uses their own decentralized interoperating network with more security and safety. The percentage of operation scalability is also good in this block chain system. The user can get the super-fast access for using their payment system globally in the world.

What is Ripple Wallet?

At this point, we will tell you how to store your Ripple by exchanging with money. So all you need to have one secured Ripple Wallet to store your Ripple point. The official and secured Ripple Wallet to store your XRP is Gatehub. This is an online service in which you need to create your account for storing your Ripple or XRP. This site helps you to store, send, receive and do much more with your Ripples.

How to buy Ripple or XRP?

This is the beginner guide to buy Ripple for the first time in a secure way. If you know about to any crypto currency then this is also similar to them. Initially what you need to do is

- Go to the Coinbase website and then register in it by providing your proper details. This is one of the secured and safest sites to purchase Crypto currency till now and regulated by US Government.

- Now purchase the Bitcoin at first and then exchange it with Ripple. If you made the first purchase of $100 then you will get $10 in free Bitcoin. In this way do the same for making the purchase of Ripple or XRP at first.

#Ripple does not use any third party site or vendor to make your payment process. They use their own peer to peer network to complete the whole payment process.

Final Words:

So these are the basic guide to buy ripple for Beginners. If you think that you also want the same benefits for your need then feel free to use the service of Ripple. Using the Ripple you can do many transactions and pay or receive money from others too. Do not need to go through the harassing techniques of the bank or other payment gateways. Simple choose ripple and enjoy the frictionless services Ripple globally as always.