Online payment has transformed our life into the easiest way and every single payment we want can be done with a single click through the internet. Whether bill payments, shopping, money transfers, or other online services, it can be done with a single tap. All the necessary records of every transaction and tracking are kept via UPI and online bank payments, adding more security for the person. Not only maintaining records but it also saves time and increases financial control.

UPI payments are done through a bank website or mobile app, we must ensure always before downloading whether the app is genuine or not because fraud websites and apps are everywhere nowadays and, to stay away from fraud we must know whether our transaction is done in the right place or not.

To add different Banks and activate UPI payments we must follow a few mandatory steps. Today Here in this article, I am going to guide you step by step to add different banks and activate UPI payments easily.

Steps to follow to add different banks and activate UPI payments:

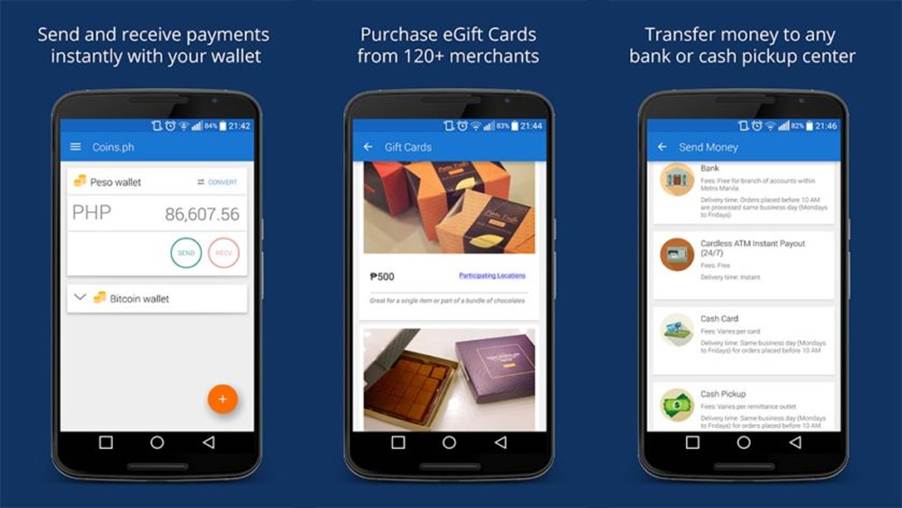

Step 1: First you need to download your required app, which is UPI enabled like Phonepe, Google Pay, Paytm, etc or your bank’s mobile app.

Step 2: Now you will have to Create a new account by Registering or Login if you have already registered using your mobile number.

Step 3: Third go to the app’s “ Link bank account” or “Add Bank Account” page/ section.

Step 4: Select banks from the list given in the option.

Step 5: Enter Bank account details such as (Account number, and IFSC code, and fill up with other necessary details required).

Step 6: Now, next step you will need to authenticate the details that you have added by providing the OTP number sent on your Registered mobile number.

Step 7: Next you will have to give your UPI PIN or passcode, for this step go to the “UPI PIN” or Create UPI PIN. To create a new PIN, you will require your Debit card’s last 6-digit number and expiration date.

Step 8: Now Activate your UPI, and you will receive a notification regarding the confirmation message of your new UPI you can automatically set your UPI address which will be your Virtual Permanent Address.

Step 9: Now, You can verify any account and use it by giving the OTP details for further completing the activation process.

These are the simple steps you can follow to add any bank account details, but always remember to keep your details secure and always try to keep the records to yourself only.

Safeguards to follow while using UPI:

While using UPI payments few important safeguards you need to take care of and follow some best practices such as

- Use a secure UPI app like Google Pay, Phonepe, or your bank’s official app.

- Setting a strong password or PIN and avoiding sharing with anyone.

- Always keep your phone up-to-date and make sure that you always stay alert in terms of your bank updates.

- Always be careful with the links you click or download, as you might be clicking unknowingly on untrusted sources.

- Always verify transactions before sending money and double-check the details before proceeding.

- Try monitoring your account activity regularly, keep your phone up-to-date with banks with registered mobile numbers, and always check your bank messages regularly.

- If any suspicious activity, report it immediately to your bank’s customer care or your UPI support regarding the activity.

- Never rush to any payment activity based on phone calls.

Practicing good habits will protect you from all kinds of fraudulent activity, especially on the matter of banks and transactions as this is among your sensitive information and you must protect it from any kind of mislead.

Faced Fraud transaction? Follow these steps:

In case if you ever face any fraud transaction through your bank or UPI account, here are the steps you should promptly follow:

- Contact your Bank immediately regarding fraudulent transactions, most of the bank services have 24/7 customer services, who will help to record your issues immediately. You can find their bank customer number on their website as customer care number respectively on their app or website.

- Request them to block your account if you face any kind of fraud transaction, or allow them to freeze your account until you get a new card or request for your new card. Blocking a card can ensure that no other new transactions will be done by the fraudents even if they try to attempt any kind of transactions until resolved.

- While reporting make sure you keep all the records ready to provide them, such as the date, time, transaction amount from which account, and any other information related to the documentation.TBottom of Form

In this article, I have written all the necessary information regarding UPI transactions. Starting from adding different bank accounts and activating UPI payment, also mentioned the safeguards to follow during UPI transactions and what to do if you face any kind of fraudulent transactions. Keeping your money safe is always a wise thing and it helps you keep yourself financially stable and secure too.

Hope this article will give you a boost help and help you in all your ways to use UPI safely. Nothing is better than keeping yourself safe from all kinds of fraud, which will keep you free and Happy.