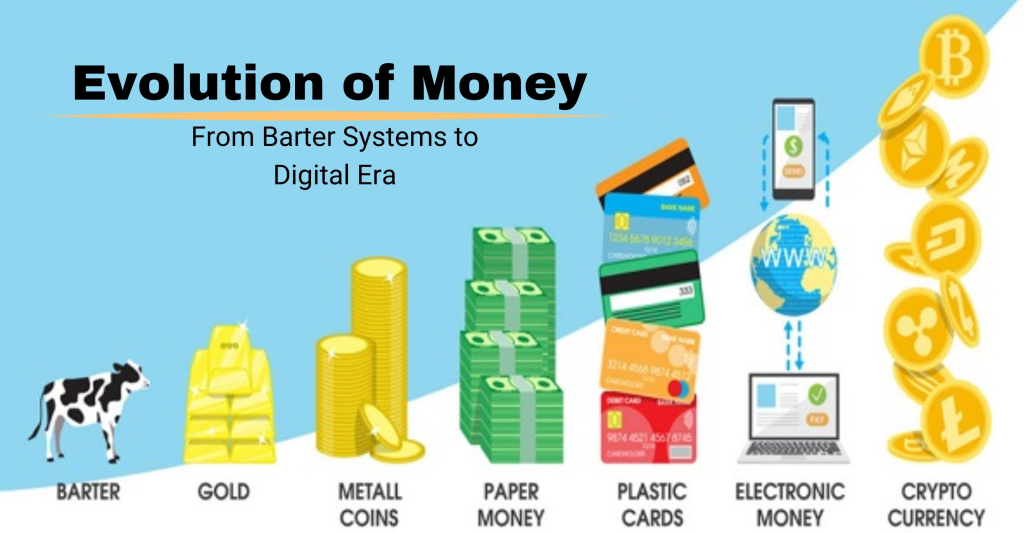

Cryptocurrency has transitioned from a speculative asset to a significant player in the global financial ecosystem. In 2024, its impact is evident in areas like financial inclusion, cross-border trade, technological innovation, and economic restructuring. However, challenges such as regulatory uncertainty, environmental concerns, and market volatility persist, influencing how nations and industries adopt and integrate these digital assets.

Financial Inclusion

Cryptocurrency fosters financial inclusion by offering decentralized financial services to underserved populations. Platforms based on decentralized finance (DeFi) provide opportunities for lending, borrowing, and saving without reliance on traditional banks, empowering individuals in developing economies to access financial tools. This democratization helps bridge gaps in the global financial system, enabling broader economic participation. Emerging markets, particularly in Africa and Southeast Asia, are leading in adoption, leveraging cryptocurrency for remittances and peer-to-peer transactions.

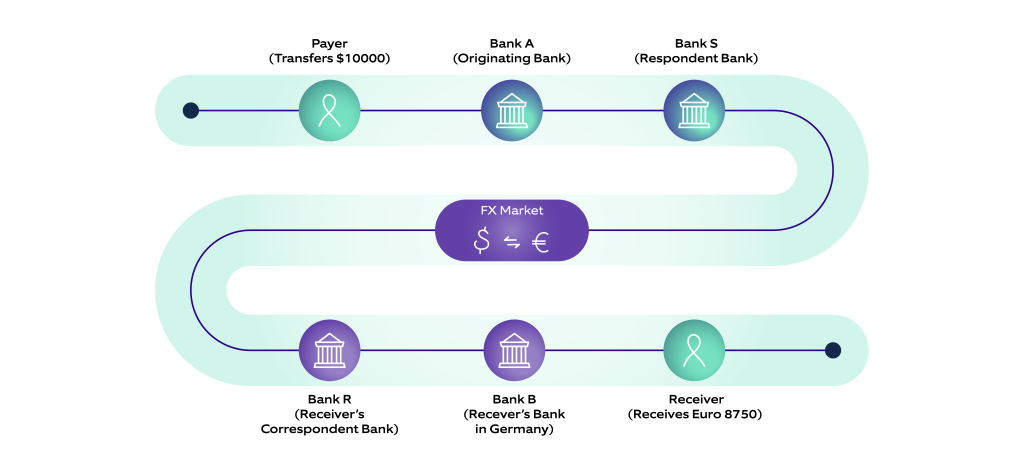

Revolutionizing Cross-Border Transactions

The borderless nature of cryptocurrency facilitates seamless cross-border payments, reducing transaction costs and settlement times. Businesses and individuals benefit from lower fees compared to traditional banking systems. Stablecoins, in particular, play a crucial role in remittance markets, providing stability while maintaining the efficiency of digital currencies. This innovation not only supports global trade but also empowers small and medium enterprises (SMEs) to participate in international markets without the burden of high intermediary costs.

Driving Technological Advancements

Blockchain, the technology behind cryptocurrencies, is transforming multiple industries. Applications in supply chain management, healthcare, and digital identity systems demonstrate blockchain’s versatility. Furthermore, developments in blockchain interoperability enhance data sharing and efficiency across networks. This interconnected ecosystem is paving the way for the widespread acceptance of digital assets and decentralized applications (dApps), driving technological growth and innovation globally.

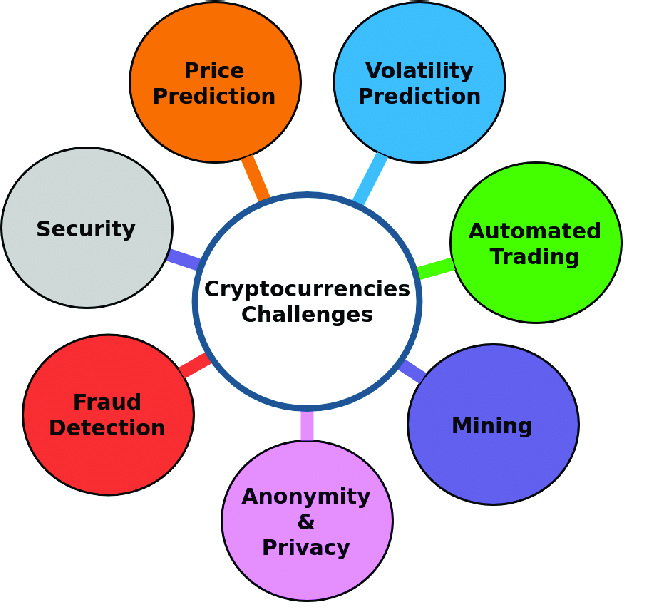

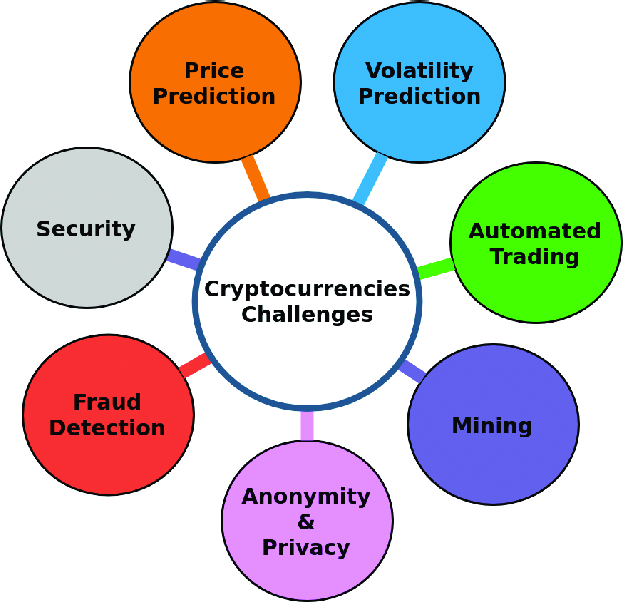

Challenges in Regulatory and Environmental Contexts

Regulatory Landscape

Cryptocurrency’s rapid rise has prompted countries to develop legal frameworks to manage its risks while fostering innovation. In 2024, the regulatory landscape is evolving, with some nations embracing crypto-friendly policies to attract investment, while others impose stricter controls. The United States and European Union are working towards balanced regulations to ensure investor protection without stifling innovation. However, inconsistent global policies create uncertainties that affect adoption and market stability.

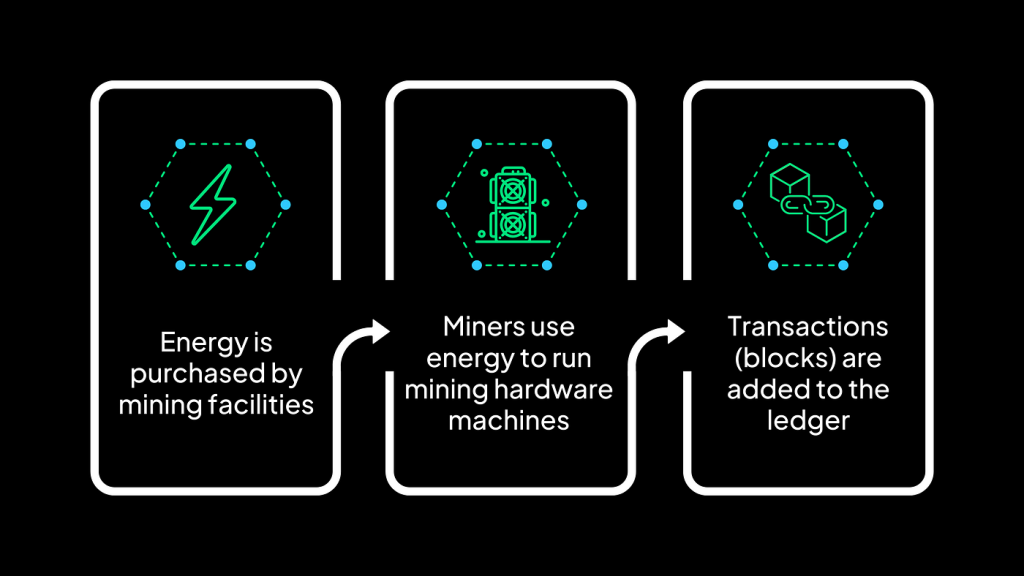

Environmental Concerns

The energy consumption associated with cryptocurrency mining remains a significant challenge. Networks like Bitcoin consume vast amounts of electricity, prompting criticism over their environmental impact. Innovations like Ethereum’s transition to Proof of Stake (PoS) have reduced energy use, setting an example for other networks. The industry’s shift toward sustainable practices, including the use of renewable energy, is crucial for long-term viability.

Economic Restructuring and Geopolitical Implications

Cryptocurrency is reshaping economic dynamics by enabling financial sovereignty and reducing reliance on centralized systems. It empowers individuals to manage wealth independently and fosters competition among countries to become hubs for blockchain innovation. Nations with favorable regulations are attracting talent and investment, positioning themselves as leaders in the digital economy. However, geopolitical tensions and regulatory arbitrage highlight the need for international cooperation to ensure a balanced and inclusive approach to cryptocurrency adoption.

Final Thoughts

Cryptocurrency is reshaping the global economy, offering transformative opportunities in financial inclusion, trade, and innovation. While challenges such as regulatory ambiguity and environmental impact persist, the potential for a decentralized financial system continues to drive adoption and integration. The future of cryptocurrency hinges on collaborative efforts among governments, industries, and communities to create a sustainable, inclusive digital economy.

By embracing responsible innovation and fostering clear regulations, stakeholders can maximize the benefits of cryptocurrency, shaping a resilient and adaptive global economic landscape.