Digital Payments is one of the fastest payment systems. UPI (Unified Payments Interface) transactions enable instant fund transfer in the form of a digital payment system in India, between Bank accounts via Mobile phones. As the payment process is very fast we also need to take care of unwanted fraud transactions that may occur without our knowledge and cause huge losses to us. In this article, I am going to share with you the most effective safeguards to protect yourself from fraudulent transactions.

As in today’s world everybody is updated along with the technology and generation, but what if we cannot protect ourselves from such fraudant transaction? Which is important to know the safeguards along with knowing how to use it?

Before we know how to protect UPI Fraud Transactions, let us go through the process on how this Upi (Unified Payments Interface) transaction works.

Here’s How a Typical UPI transaction Works:

- Initiation: When you initiate payment through your UPI-enabled mobile app, your transaction begins. E.g., Google Pay, Phonepe, Paytm, BHIM, etc) to process the transaction you will need to enter the recipient UPI ID, Scanning QR code, or Mobile number linked with the UPI ID.

- Authentication: This authentication ensures to security of the payment, using UPI PIN which is only known to you and your account is secure enough for the transaction.

- Confirmation: After your authentication is done, all the details of the transaction are sent to your bank for the process and the recipient bank is also notified of the payment request.

- Fund Transfer: The funds you request are ready for the instant transaction from your bank account to the recipients bank account linked to the specified UPI ID.

- Confirmation to Recipient: The sender and the recipient instantly receives message upon successful transaction of funds into their bank account linked to the mobile number respectively.

- Transaction History: Transaction details history can be seen by Both the sender and the recipient on their respective bank statements and UPI apps.

UPI transactions are always known for the speed and convenience transactions. Whereas using UPI is not the only thing you should be knowing, Precautions and all the safeguards to know for protecting your money is always the wise and best decision in today’s world.

Now, Let us go through the main topic, by which you can protect your fraud UPI transactions and be aware of such fraudent transactions:

Safeguards to Protect your UPI Fraud Transactions:

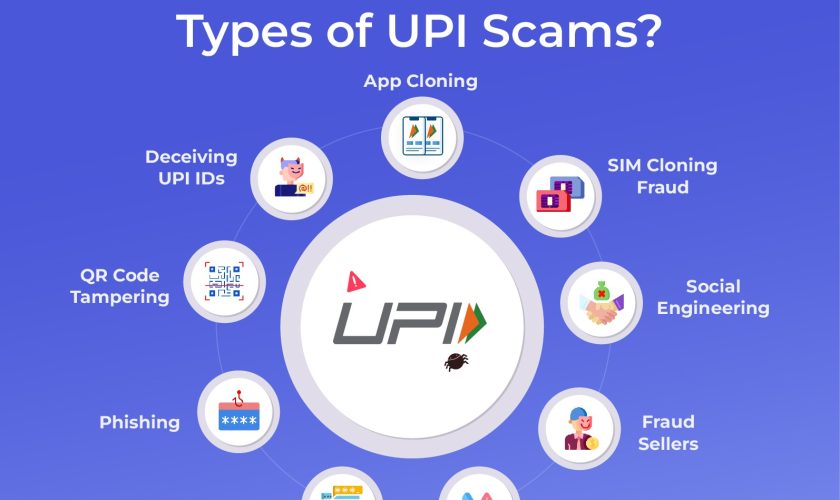

UPI Fraud transactions is referred to the transactions which is conducted by other unauthorized without your knowledge. Here, I will be sharing some common types of UPI fraud transaction along with how to protect from such types of transaction:

- Sim-swap Fraud: You may unfamiliar with the word sim-swap, but yes this kind of fraud exist. Fraudsters may trick your mobile service providers, which is SIM provider and issue a new SIM linked to your mobile number. Once they able to activate the SIM they will be receiving all the OTP (One Time Password) and conduct all the necessary transactions by accessing to your bank account.

Safeguards: As soon as your SIM drops signal or network, immediately contact your Mobile SIM provider or incase if you receive a notification regarding new SIM swap request which you did not initiate and not aware of it. Make sure you enable SIM card Protection services in order to protect your SIM by your SIM card provider for more safety. - QR Code scams: Frauders are very clever to manipulate normal human beings, and so you can be one of their target. They might manipulate QR Codes to redirect payments to their bank account, replacing the intended recipients account.

Safeguards: To protect this kind of transaction you always need to verify the recipients details and amount before and after scanning QR codes. Always use QR codes directly from merchant or trusted sources. - App Cloning: Fake apps can be created by the fraudsters to manipulate and resemble as the same UPI app, which you are looking for, and by which you may be tricked to download their app. Those fake apps can capture all your bank details with banking credentials.

Safeguards: Always download app from official app stores such as Apple App Store or Google Play store. Rather than that do not download from any other unofficial websites. Also verify the Developer’s details and read the app reviews in order to be safe from all sides. - Phishing: Fake messages or emails can be send by the fraudsters, pretending to be from the bank or other UPI provider. Using your information they conduct unwanted transactions by asking your sensitive information, OTP (One Time Password) or by asking your UPI PIN.

Safeguards: Never Share OTP passwords or UPI PIN to any one. Bank and other Network providers never ask such sensitive information from their customers. Always verify your messages and email before sharing any kind of information to other unknown. - Social Engineering: By giving Fake offers, fake impersonating bank officials, fake calls or fake customer support calls, fraudsters may try to manipulate individuals in order to take their passwords easily with their quality and attractive offers and support.

Safeguards: Beware and Be cautious from those unsolicited messages or calls, asking for your UPI or banking details. Do not share your PIN or passwords or OTP to any unknown or unauthorized in any communication before responding.

These are the following significant guidelines, which you can follow to reduce the risk of falling victim to UPI Fraud transactions. Incase if you become a victim, immediately contact your bank’s customer care and report the following details and incident. Banks and other officials never ask for the sensitive personal information and Banks will look and investigate to this matter once your report promptly.